Instant Car Insurance Quotes – Texas

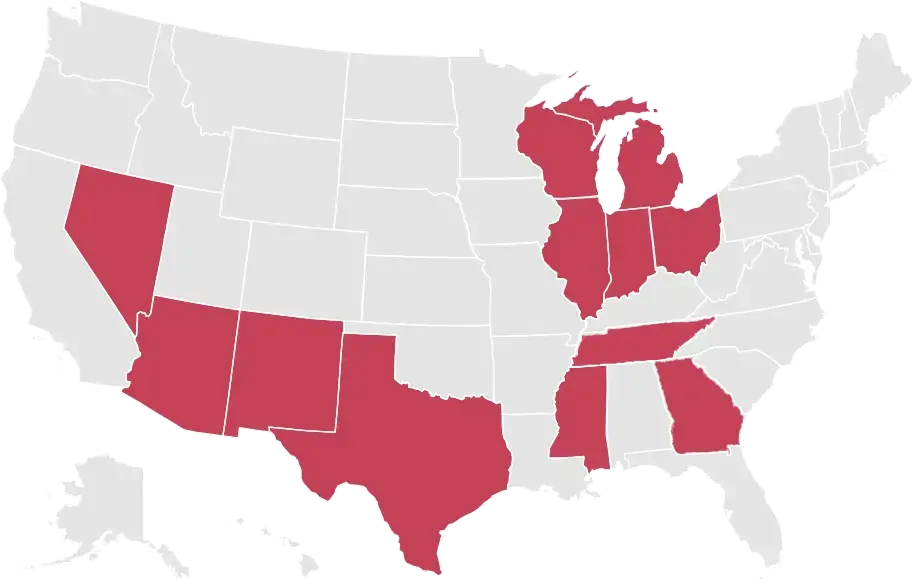

Looking for cheap insurance in Texas? At Accurate Auto Insurance, we’re dedicated to helping customers in the Lone Star state find the right policy for their vehicle and budget. It only takes a few minutes to get the coverage you need to get back on the road.

Enter your zip code or call us now to receive an instant quote!

Cheap Liability Insurance in Texas

Finding the right car insurance doesn’t have to be a hassle. We provide you with the lowest quotes possible to make sure that anyone looking for cheap auto insurance in Texas can get the coverage they need. We provide plans with the minimum coverage requirements necessary to operate both vehicles and motorcycles.

What are the Minimum Requirements for Car Insurance?

The answer to this question varies by state. In the State of Texas, all drivers are required to have liability insurance, which provides coverage for injuries and property damage caused by the policyholder. This coverage needs to meet state minimums, which are sometimes referred to as 30/60/25 coverage:

- $30,000 because of bodily injury to or death of one person in one accident.

- $60,000 because of bodily injury to or death of two or more people in one accident and may be subject to the 30,000 limit per person.

- $25,000 because of injury to or destruction of property of others in an accident.

Don’t Drive Uninsured!

Driving without insurance is a recipe for disaster. Not only can uninsured drivers get in hot water with the law, they may be on the hook for costs associated with a car accident. Cheap liability car insurance in Texas allows you to legally drive and limits your financial responsibility in the event of a car accident. Without car insurance, you could be held directly responsible for another’s medical bills, the cost to repair their property, or to replace it.

SR-22 Insurance in Texas

We offer cheap Texas SR-22 insurance and high-risk insurance in Texas. We believe in providing affordable car insurance to all customers, including those in legal need of SR-22 insurance. No matter your driving record, we want to help make sure that you can obtain legal and affordable coverage.

What is SR-22 Insurance?

Those who have had their license suspended or revoked may be required to get an SR-22 certificate in addition to minimum insurance coverage. An SR-22, also referred to as a Certificate of Financial Responsibility, can be necessary to reinstate and maintain driving privileges. This certificate acts as proof of insurance, showing the state that the driver has acquired at least the minimum coverage necessary and will retain it for a certain period of time.

Some insurers, like Accurate Insurance, will file an SR-22 form on the policyholder’s behalf so that they can legally begin driving again. Once the certification has been issued, it’s important to keep the car insurance policy in good standing. Insurers are legally required to report lapses in the policy caused by missed payments or cancellations.

Affordable SR-22 Insurance Rates in Texas

At Accurate Insurance, we’re committed to making the hunt for affordable car insurance easier for drivers in need of an SR-22 in Texas. We’ve streamlined our application so that customers can get insured online in 4 minutes or less. To get started, simply enter your zip code on our website or give us a call to discuss quotes over the phone.

FAQs – Texas Auto Insurance

We’ve answered some of the most common questions customers have below. Don’t see your question? Reach out to us for help.

How Much Does Car Insurance Cost in Texas?

Car insurance rates can vary greatly depending on many factors, including the applicant’s age, driving record, and the company they choose. Young drivers and those with a checkered history behind the wheel are considered higher risk and will be more expensive to insure. Our team works hard to make sure that every customer finds the cheapest car insurance rates around.

Will My Credit Affect the Cost of My Insurance?

Many car insurance companies in Texas take credit score into consideration when generating quotes for a prospective customer. At Accurate Auto Insurance, we do not conduct a credit check during the application process. This allows us to help more customers access the affordable car insurance they need to drive legally.

Get Insured Today

Accurate Auto Insurance is working every day to help Texans obtain the coverage they need to legally drive. We work with many customers seeking high-risk Texas SR-22 insurance at the lowest possible rates. If you suspect that your current or previous auto insurance company has been overcharging you, allow us to show you a quote that you’ll love!

Visit our website to get your FREE auto insurance quote, or give us a call to discuss setting up a new policy over the phone.