When it comes to some things in life, perfect timing can make a big difference. Unlike plane tickets, new cars, and hot electronics, car insurance never goes on sale. However, even without a set sale season, timing can play a role in getting a great rate. The difference is that the perfect time to find the best auto insurance in Illinois depends entirely on you—if your rate is working for you, where you’re at in your life, and how soon you want to change your policy.

Signs Your Current Policy Isn’t Working For You

While many people have gripes about paying for their insurance plan, that doesn’t necessarily mean it’s the wrong fit. Like taxes or the cost of necessary healthcare, car insurance is something all responsible adults need to pay for. If you’ve begun to suspect that you don’t have the best rate or plan possible, here are some points to consider.

-

You’re barely able to afford your plan. Affordability is definitely an important factor when considering your insurance. If you’re scraping by and out of funds by the end of every month, your car insurance is one thing you may want to reconsider.

-

You’re underinsured. Is your plan not going as far as you wish it would? Do you feel like you’re getting less coverage than you expect considering your high premiums? It may be a good time to trade up and look for a better value plan.

The Right Time to Reassess Your Current Plan

The ideal moment for a new auto insurance plan will vary person to person. Here are some indicators that you may want to begin looking around for a better policy.

-

Your insurance policy isn’t working for you. Whether it’s a matter of affordability or lack of coverage, you deserve auto insurance that covers both bases.

-

You’re about to undergo a major life change. Are you moving or getting married? Is your child just beginning to drive or leaving for college? These are all factors that can influence the cost of your plan, making any such event a prime time to shop around.

-

You’re ready to buy a new car. A new car (or new-to-you car) will almost certainly result in a change to your car insurance rate. Reviewing competing quotes at this stage can help you be sure that you’re moving forward with the best plan.

You Can Get a New, Better Policy at Any Time

Unlike mobile service agreements, health insurance policies, and rental agreements, most car insurance agreements only last six months. This allows insurers to quickly adjust your plan, such as with a rate hike after an accident. Many companies, if not most, will allow you to cancel your plan at any point in the agreement. It’s best to check with your insurance company directly before you make your move, including any fees that may be associated with ending the policy.

What to Know About Auto-Renewals

If you’re the type who likes to ‘set it and forget it,’ you may have opted for an auto-renewal of your plan when you signed up with your insurance company. Your insurance company will likely notify you with a paper and/or electronic message about a month before your policy is set to renew. While this may come across as a non-negotiable statement, this is actually a great time to look for a different plan.

Should I Cancel My Auto Insurance Before Signing Up?

No. In order to avoid driving uninsured for any amount of time, it’s best to have your new plan in place before canceling your existing plan. Auto insurance quotes don’t last forever, and it’s very possible that a driver could miss the window to take advantage of it while waiting to cancel their current policy. Getting your new plan buckled down before ending your old one will ensure that you are covered either way.

How to End Your Agreement

Once you have a new plan ready to go, reach out to your car insurance company to determine what steps you will need to take to cancel your plan. Some insurers will accept verbal terminations over the phone, others may require a written request in order to make it official. Written cancellations should include a statement of your intent to cancel the policy by a certain date, a request to cease charges and return unused funds, and the expectation that your cancellation be confirmed in writing.

Looking for the Best Auto Insurance in Illinois?

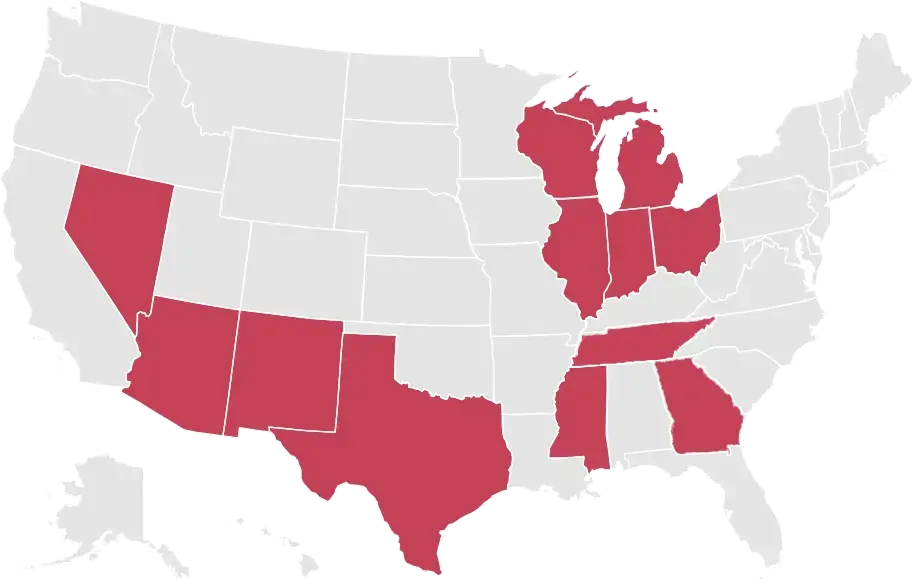

Accurate Insurance works with many people who are fed up with their unaffordable, unhelpful insurance companies. Our team is committed to helping customers acquire the best auto insurance in Illinois that they can. We guarantee the lowest possible rate to everyone who calls our hotline, applies through our website, or visits our locations for help. Visit our website to learn more about us and get started today!